According to a survey carried out by the AA a few years back, they found that after mortgage repayments, home maintenance and repairs were the next biggest cost for homeowners. They found that the average home owner will spend (and need to set aside each year) €1,290 every year to keep up with wear and tear in their home.

As with any large, once off, unexpected expense, it can throw our finances out of whack and put a dent in either your savings which were set aside for other purposes or increases the amount of debt we have because we have to borrow to carry out whatever maintenance is required. We know the best way to overcome these shocks are to plan in advance for them and the best way is to build this expense into our monthly budget and set aside a certain amount each month so that when something needs to be repaired, up-graded or replaced you have the money set aside specifically for that purpose. And when people populate the budgeting template for me, the amount they set aside varies from €0 up to the maximum I have seen of €2,000. However, I do think people get confused when recording this amount in their budget because I feel people are putting in an amount they plan on spending on their house for home improvements (non-essential spending) rather than home maintenance (essential spending) Anyway, it is important you don’t confuse the two and what I want you to consider and reflect on is the amount you need to budget for essential repairs. The question of course is how much should you set aside each month? And this is a really difficult question to answer so to help you with this, I did some research as to what the optimum amount should be and I found there were two rules of thumb that I thought made the most sense, were the most practical and were the easiest to remember. And the first rule of thumb is called the one percent rule which states that you should set aside 1% of the value of your home for ongoing maintenance. So, if your house is worth €150,000, you should budget €1,500 each year for maintenance. This figure, or any figure by the way doesn’t mean you are going to spend that amount every year, some years you will spend less and other years you will spend more, but on average and over say 10 years, this is the average amount you will spend each year. The second rule of thumb for the amount you need to budget for home maintenance each year is related to the square footage of your house. For every square foot you should be setting aside €1 for maintenance and repair costs. So, if your house is 1,800 sq ft then you need to be budgeting for an average annual cost of €1,800 over the long term. And this method of determination might make slightly more sense than the first because the more square feet in your house, the more you have to manage and repair as opposed to what the house is valued at. But what you don’t have control over using this rule is the cost of labour and materials which may vary depending on where you live – in certain parts of the country, contractors and the costs of materials could be significantly more expensive. I am going to come back to which rule I personally use at the end of this article, but before I do, I want to look briefly at those factors that make the biggest impact on the amount we spend on our houses each year. And the first is obviously the age of your property. You would like to think that any property built in the last 10 years would need very little maintenance, but the chances are probably good that as a house gets older the cost of maintaining it will increase. My own house is 30 years old and we are in it 12 and we are beginning to see the importance of setting aside money each month because every year we are seeing the amount we are spending on it increase – this year we need to give the heating system a much needed makeover. Another factor that will influence how much you will spend on your house each year is the weather. Friends of ours have a property in West Cork and they tell me that their house is frequently subjected to heavy winds and rain together with long periods of below freezing temperatures and the impact this has on the exterior and interior of their house and the amount they have to spend to repair it each year is significant. There are many other variables that will impact how much you should budget for repairs and maintenance each year, including the location and type of property you have, but that said, I think it is prudent to combine the 1% and square footage rule when figuring out how much you might need each year and this is what I do. If for example your property is worth €250,000 and the square footage is 1,500, then the average of both is €2,000 and that is what you should budget for each year. And furthermore if your property could be adversely affected by its age, weather or location, then add another 10% for each of these factors to the overall amount you should set aside each year. It is hard to predict how much it will cost year on year to maintain your home, and like many other areas of your finances, the best you can do, is make an educated guess and using these rules is a very good starting point.

0 Comments

Single Assessment Under assessment as a single person, each spouse is treated as a single person for tax reasons. With this option:

Separate Assessment Under the separate assessment option, the tax affairs of spouses are independent of each other. The difference between separate assessment and assessment as a single person is that under this option, some tax credits are divided equally between you. These tax credits are:

Joint Assessment The joint assessment (or "aggregation") option is usually the most favorable basis of assessment for a married couple. This option is automatically given by the tax office when you advise them of your marriage but this does not prevent you from choosing to be assessed individually or separately. Under this option, the tax credits and standard rate cut-off point can be allocated between spouses to suit their own circumstances. If only one spouse has taxable income, all tax credits and the standard rate cut-off point will be given to the spouse with the income. If both of you have taxable income, you can decide which of you is to be the assessable spouse. You then ask the tax office to allocate the tax credits and standard rate cut-off point between you in whatever way you wish. If your tax office does not get a request from you to allocate your tax credits in any particular way; the tax office will normally give all the tax credits (other than the other partner's PAYE and expense tax credits) to the spouse being assessed. The spouse being assessed must complete the return of income for the couple and is chargeable to tax on the joint income of the couple. If one spouse is self-employed, joint assessment can still apply. The flexibility this option brings can be very convenient - especially if one of you pays tax under the PAYE system and the other pays tax under the self-assessment system. Under joint assessment, you let your circumstances determine if most of the tax should be paid under PAYE or in a lump sum on assessment. This is determined by the way in which the tax credits are allocated. If you choose to pay most of your tax under PAYE, the tax credits (apart from the PAYE tax credit and employment expenses), should be offset against the self-assessment income. The choice about who becomes the assessable spouse is made by both of you. All you need to do is to inform Revenue which of you is to be the assessable spouse. If you have not made your nomination, the assessable spouse with the higher income in the latest year for which details of both spouses' incomes are known becomes the assessable spouse. This person continues to be the assessable spouse until both of you jointly elect that the other spouse is to be the assessable spouse or until either of you opts for either separate assessment or assessment as a single person. In my opinion it is much more beneficial to be assessed jointly rather than individually so I would suggest that if you are married but taxed individually you should notify the Revenue if you have not done so already and ask them to change your method of assessment to joint. And who knows if you forward them your P21’s for the last few years for both of you (the year of marriage will not be factored into calculations for joint assessment) you may even be due some tax back.

And financial therapy, which is growing in popularity, is exactly what it sounds like, a combination of psychology and financial advice, the problem, however, for people is that financial advisors will only focus on numbers and feel uncomfortable talking about people’s emotions and on the flip side, therapists are not trained in dealing with money but are happy to talk about people’s emotions.

Like any other disorder, a money one is where there is a persistent pattern of self-destructive behaviour and according Brad Klontz, who is a leading expert in this area, they begin at a very early age, where we get distorted beliefs about money, which Klontz refers to as "flash points" - these are painful distressing and dramatic life events associated with money that are so emotionally powerful, they leave an imprint that lasts well into adulthood. And I absolutely get this because I meet so many people every week who have particular issues and struggles with money and when you talk a little bit more with them and dig a bit deeper, it becomes obvious why this is the case because more often than not an incident happened in their past that continues to affect them and their relationship with money. In a survey carried out last year, it was found that people feel more shame around money issues than they do around sexual problems - lying to their spouse about their spending, feeling guilty about how much money they make, spending money to make them feel better (doesn't last long by the way), not spending money at all, are just some of the disorders people suffer from but the top five most commonly recognised money disorders are: 1. Frugality 2. Denial 3. Dependency 4. Rejection 5. Enabling I think we all know someone who we think still has their communion money, but for them the reason they don't spend money is not because they enjoy saving money, the reasons run much deeper. About six months ago for example, I met with a very successful lady in her mid 40's, who had risen through the ranks and was now a senior vice president in a multi-national IT organisation. She had more money than she could spend but that was her problem, she wouldn't spend any money on herself or her family. She was incredibly insecure about money and was always worrying that if she ever lost her job, she would run out of money so she hoarded it. After about an hour of chatting, she shared with me that she was the eldest from a family of seven and was raised above a pub in Kerry where her father was the proprietor. She broke down while telling me how her father had been an alcoholic and any money he made, he drank. Herself, her siblings and her mother often went without food because they had no money and she saw the impact it had on her sisters and her mother, so subconsciously I think she vowed to herself that when she was older, she would never run out of money and one way of doing this is never to spend it and never stop earning it. The difficulty with this type of person is that they are hard to cure because they don't see anything wrong with their behaviour. They live in a constant fear of financial ruin and will always worry that they will end up destitute no matter how much money they have. They put off buying things that would make a positive difference to their life, because they don't want to spend any of their money. And the problem with what we have gone through as a nation in the past eight years is that we may have bred a whole new generation who will suffer from this disorder - that is the children whose lives have changed dramatically because their parents lost their homes or jobs due to the recession. If you think, you, your spouse or someone you know, suffers from this type of disorder, well some help is at hand because research carried out by social scientists show that the following strategies can actually help: 1. Use plastic instead of cash - you would think that someone who hates spending money would never use credit cards but it has been proven that when they do, they will spend more than if they were to use cash so getting them to use a pre-paid credit card would be a good thing 2. Focus on long term benefits - under spenders are more likely to part with their money if they believe the purchase is a good long term investment. Joining a gym for example and getting healthier will improve their health and reduce their future medical expenses. 3. Bundle purchases - under spenders hate buying individual items but they really like buying things that come in a bundle like phone/internet/tv packages and if they decide to go on holiday, guess which one they will go on - yes you are right - the all-inclusive one. In Ireland we all know what we should be doing - spend less and save more - so more information about how we spend our money is not going to help - we need to look deeper at the emotional issues behind the problem - When you think about dieting and exercising for example, most people know that if you exercise more and eat better your health will improve, so why don't we act on this information instead of becoming the second most obese nation in Europe - it appears to me that we cannot blame a lack of information and understanding for these problems and the same goes for money issues - getting to the root of doing things that you really don't want to be doing whether that is over or underspending, lying to your partner about debt or feeling guilty about how much you earn are emotional problems that we need to help people with. Next week I will look at the other money disorders people suffer from, identifying their symptoms and looking at what coping mechanisms and strategies they can take to help manage them better.

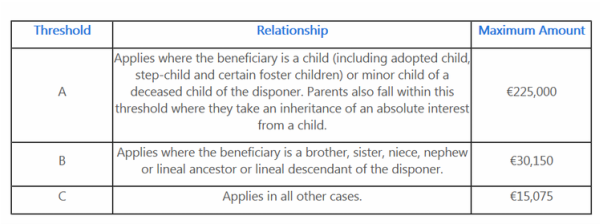

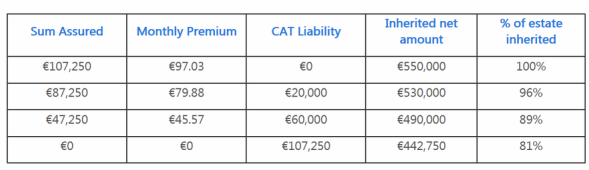

The amount you can gift or inherit from someone depends on your relationship with them. There are currently three bands that have different thresholds at which they can receive a lump sum without incurring any liability and they are: Anything above each threshold is taxed at 33% - so the value of what a child would inherit would have to be not greater than €225,000 before capital acquisition tax (CAT) kicks in. If someone for example was to inherit a property worth €450,000 and cash worth €100,000 then the amount that would be payable to Revenue would be €107,250 i.e. €550,000 - €225,000 x 33%. The threshold amounts have gradually come down each year whilst the tax rate has increased. For example back in 2009, a child could inherit €542,544 from a parent, and the balance was taxed at 22%. Anyway, is there anything that can be done to prevent this from happening? And the answer is YES. There is a life assurance policy often referred to as a Section 235a policy which is arranged for the specific purpose of providing funds on death to pay inheritance tax likely to arise from the death of the policy holder. The term Section 235a refers to the section of the Capital Acquisitions Tax Consolidation Act 2004 which provides a relief for inheritance tax for the proceeds of policies arranged for this purpose. The proceeds of a Section 235a policy are also exempt up to the amount of any approved retirement fund (ARF) tax arising from the death of the deceased policyholder. If we look at the figures I have just used, the cost of putting a policy in place to eliminate an inheritance liability of €107,250 for a 45 year old male would be €97.03 per month (this monthly premium is the best in the market and is with Irish Life) Let me give you an example of what this would look like and what other amounts would cost as well: I think it is worth looking at this further based on the value of your own estate and what your children will be faced with now when you are young enough to do so because as you get older and your estate becomes more valuable, the cost of taking out such a policy would be so large it would really become prohibitively expensive.

I have come across many people who are inheriting money from their parent’s estate and the amount they have to give away in inheritance tax is enormous and they only wish their parents knew of or took out such a policy when they were young enough to do it. It would have saved them hundreds of thousands of Euros, and of course some parents take the view that the amount their children inherit is going to be large anyway even after paying Revenue so it depends on your outlook. There is a second way of avoiding incurring this liability particularly if the property you inherit is your principal place of residence along with other conditions that are

The offer is not conditional on you taking out a fixed or variable rate offering either, the product you choose has no bearing on the 2% incentive. Is it worth taking them up on this offer then? Well their variable rate for example is one of the highest in the market if the loan to value exceeds 80% at 4.5%. And when you compare this rate to other providers who are charging a lower rate of 3.9% the difference in monthly repayments assuming a mortgage of €250,000 over a 25 year period is c. €84 per month. If rates stayed the same then the breakeven point when the €5,000 is used up to make up the difference in monthly repayments is at month 59 (€5,000/84) So, whilst the lure of immediate cash is attractive particularly to first time buyers who might need the funds to furnish the property or replace savings used to gather the deposit, the long term benefit might not be assuming rates stayed the same over the mortgage term, for example, when you compare one lender offering cash back incentives with higher rates and another offering no incentives but lower rates, you find the following assuming a loan amount €250,000 over a term of 30 years: Cash Back Incentive but Higher Rates Institution: Bank of Ireland Interest Rate: 4.5% Total Interest Repayments: €216,016 Less Cash incentive of €5,000 Total collected by Bank of Ireland: €201,016 No Cash Back but Lower Rates Institution: AIB Interest Rate: 3.9% Total Interest Repayments: €174,501 Less Cash Incentive €0 Total collected by AIB: €174,501 So, the question I guess here is can you do more with the €5,000 right now than you could with repaying €884 more each year than you need to for the next 30 years?

Let me explain further.

One of my favourite personal finance authors, David Bach, suggests that if you save 1 hour of your income every day and spend the rest on everything else, you will accumulate a significant amount of money and the math actually backs his claim up. The average weekly wage in Ireland is c. €700 which translates into an hourly salary of €22 and I know for many it may be over this amount but for the purpose of this exercise, let me work off this figure. So, let’s assume that you and your partner commit to saving 1 hour of what you earn every day:

In Bach’s bestselling book, Start Late Finish Rich, he claims you don’t have to start saving very early to end up with a large amount in your savings account when you are older, but obviously saving at a younger age will help you get there easier and faster but it is not beyond anyone’s reach, regardless of their age to build up a significant of money – all you have to do is commit to saving 1 hour of your income every day, can you that? So how about the amount you earn between 9am and 10am every day is yours to keep and is going into a savings or pension account and the amount you earn for the rest of the day can go towards taxes, loan repayments, utilities and so on. And I appreciate this is easier said than done given the cost of servicing debt and the costs associated with raising children and so on but if you did find it difficult to save 1 hour of your income every day, could you and your partner save 20 minutes? Because if you did, in 25 years you would have c. €362,272.15 sitting in your account so it doesn’t have to rounded to saving an hour of your income either, don’t discount smaller amounts and think the amount you will accumulate won’t be worth the effort, this clearly isn’t the case. When it comes to saving and how much we should be setting aside each month, I believe we need to start changing our behaviour and our mind set from saving a certain rounded amount each month to saving based on the amount of time we spend working each day and paying our self a portion of the income we receive for that day. When I ask people about the amount they save each month and why it is a particular amount, I would say that nearly 100% of them have no rationale behind the number – it’s an amount they feel they can afford to set aside each month or it’s even a number they continued on with from the good ole days of the SSIA accounts of the 90’s. And some of the amounts are quite big but when I equate them to the amount they earn each day, they are small, so do people not value their time and effort and the amount they earn as much as they should? One person I was working with recently was saving €250 each month, an excellent figure, but this amount compared to the number of hours he was working each month was actually very small because he was saving just 3.7 hours out of a typical month which saw him work 180 hours. And please do not get me wrong, I am not suggesting that we should all work as hard and as long as we can now and save every cent we earn, so that we can live comfortably when we retire. Doing this would be insane because you would be denying yourself the things that keep you healthy, happy and sane today but we do need to start valuing our time a bit more because if we do, our savings levels will soar and I’m betting our productivity levels at work will increase as well. We work on average 1,529 hours per year, and let me refer back to the example about a couple saving 20 minutes of their income every day because if they did, they would accumulate c. €362,272 in 20 years – do you know how many hours that is over one year – it’s just 174 hours’ between them out of an average of 3,058 working hours for two people – it doesn’t seem that much when you look at it this way does it? And again it is very important to consider saving this way otherwise, your chances of achieving a considerable sum of money or becoming that millionaire from saving alone are greatly reduced. If you just randomly select a rounded number, with no great particular though process, then this is what is going to happen: If you save €100 per month, it will take you 58 years 6 months before you reach the magic €1M. It means if you are 25 you will be 83 years old before you can call yourself a millionaire. If you double the amount to €200 per month, then it will take you 48 years, if you save €400 you will be a millionaire in 39 years’ time - €750 per month will take you 31 years and €1,000 in 27. For me, when it comes to saving each month, it always helps if you have a reason why you are saving in the first place. And it is a question I ask of my clients all of the time – why do you save as much or as little as you do and what are, you trying to achieve? And most people tell me it’s for security, or for freedom and then we speak a little more the real reasons come out: “I want my children to have more opportunities than I did” “I don’t want to worry about money like my parents did” It might be a useful exercise for you after you have read this article to give a little bit more thought to why you are saving in the first place. And to help you uncover your reasons you should look at:

And the reason why I save everything I earn everyday between the hours of 8.30am and 9.15am are because I consider my family to be my highest priority and I work as hard as I do, because I want the financial freedom to be able to spend as much time with Roseann and our three children and give them a foundation for a life full of opportunity – that’s my WHY.

Whether you think you know everything or very little, if you can’t give me the numbers to the following 5 areas, then you had better get working on finding out what the answers are.

And the first number is one that you would think everyone would know but you really would be surprised how many people don’t: 1. Your Monthly Income I asked a client of mine last week, what her annual salary was? And she looked back at me with a blank expression on her face. She admitted to me that she hasn’t opened a payslip in 2 years. She could tell me by looking up her bank statements what was lodged into her account each month but had no idea how that figure came about. She had no idea about how much tax she pays each month and by not looking at her payslip she couldn’t tell me how much was going into her pension – and when we looked at her payslip, nothing in fact was going into her pension, ZERO. She had assumed that something was going in and she was with her present employer for the past 4 years and by not taking notice of her payslip and what she was being paid or what was going into her pension (nothing in her case) she missed out on FREE MONEY from her employer who would have put c. €37,444 into her pension had she instructed them to and had she joined the company scheme. Just take a little bit more notice of what your gross and net income is. Familiarise yourself with your payslip – are you receiving the correct tax credits, what is your monthly cut off point are all questions you need to get the answers to and if you don’t know, ask your employer or better still ask them to get a presentation carried out for you and everyone else who mightn’t know either and I can tell you that will be probably 99% of the workforce. Income tax, prsi, usc probably account for the biggest % that is taken from your monthly pay cheque so get familiar with it and make sure you are not paying any more than you need to. 2. Net Worth So, what are you worth right now? If you subtracted everything you have that has any monetary value from the total amount you owe, what number would that be? Would it be a positive number of a negative one? Knowing what your net worth is, isn’t just for wealthy people, everybody should know what their number is. This exercise provides a great snapshot at a point in your life as to what your financial balance sheet looks like. If it’s positive then great but how positive should it be? You know what my formulae for working out what it should be, is: Your age x gross annual salary / 10 If you are below this number or you are starting from a negative position then fine, no issues, now you have a number that you can aspire to. Diagnose or get someone to do it for you where you are going wrong and then create a plan that will get you into a positive number. And having that formulae is a great tool to benchmark your progress against each year, you can create a timeline that in 5 years’ time your net worth should be X and if I do the following i.e. investment more, pay down debt, get a second source of income, increase your main source of income etc. that you will achieve that number. 3. Monthly Outgoings This is one that very few people know and their guess is that whatever they earn is the amount they spend! You have got to get a grip on your monthly expenses. And if you don’t know what it is, then please write down what you spend your money on for 1 month in a diary, an excel spreadsheet or better still on My|Money’s spending planner. This is a great exercise it really is, a pain I know but at the end of the month it will give you great clarity as to where your money is going each month. And what this exercise is all about is awareness, because only when you know what you are up against can you put a plan in place to improve your monthly cash flow. It really is like losing weight – what is the first thing you do when you want to lose weight? You weight yourself – that is your starting point, your anchor number that you can measure your progress against. The same thing applies with your monthly cash flow, step on the scales by knowing how much you spend each month and what you are spending it on. 4. Your debt to income ratio While your net worth looks at how much more or less you have when you look at your assets and liabilities, your debt to income ratio is the one that will tell you how much of your monthly income is going towards servicing monthly debt. Any idea what your number is? Your starting point is to figure out how much you are paying each month on your mortgage, car loan, visa, personal loan and so on. Divide the sum total of theses repayments against your net monthly income and that is your debt to income ratio number. And you don’t want it to be any more than 30%, you really don’t. I carried out this exercise with someone recently and their debt to income ratio number was 40.27% - it shocked her that for every €100 she earned, €40 was going to repay debt and €22 of that was only going towards servicing interest payments. So, we did something about it and with a bit of rescheduling of debt repayments/getting lower interest rates and using some of her existing savings to pay down debt, her number is now 26.25%. 5. Your investment returns You might know the amount you have on deposit, but knowing what interest rate you are earning is another thing. I want you to actually know two numbers here and they are (a) the interest rate and (b) the amount of interest you will earn in 12 months. Are you making the most and best use of your money? Could it be earning more elsewhere? Again, I met someone recently and when I asked them how much they have on deposit, the answer was €40,000. Good start, next question, what interest rate is this amount earning? Mmmm not quite sure, 2% I think (the rate was in fact…….wait for it……….0.05%) So, how much interest did you earn last year? Again not quite sure, about €200 I think. The amount of interest he earned was ZERO, in fact it was costing him money to have it on deposit when you factor in DIRT and inflation. Whilst that was bad enough, it was the opportunity he was losing on by not investing in better yielding accounts. Again it was all about awareness, he found out his number investment return number each year was -€38 and he made it become +€708. It’s easy to get overwhelmed when it comes to money, I get that. People also lack the time, energy and interest in getting to know numbers, terms and conditions of accounts etc. But if you do take the time out and get to know just a few important numbers and how they can impact your financial life, you will realise that people who are in control of their financial life are those who are in the know.

The Good:

The Bad was:

But it was actually a great way for us to start our conversation and a little bit easier for her to talk, think and reflect on each area of her finances and compartmentalise them into good, bad and ugly sections. Because, sometimes, it is hard to know where to begin when it comes to you and your money, where do you start? Is there any point looking at the good things you have done? Does it matter what the value of your property is? Does it matter how much you owe in credit card debt? Does it matter how much you earn? And the answer is that they all matter because they are all linked and each area has a direct impact on the other so they are all important, but you need to take the step of putting down everything on paper, warts and all. And whilst I am a big advocate of people completing a statement of what their net worth is so they benchmark themselves against what their peers have, along with using it as a method of recording how their finances are progressing against goals they set themselves i.e. save €X amount or reduce mortgage by €X amount over 12 months, it is only a measure of what they are financially worth, and that is a problem. When this lady began talking about The Ugly part of her finances, she couldn’t record how she was feeling about her husband on a statement of net worth. So, it was good to talk about what she thought was one ugly part of her finances because up until she mentioned it, she didn’t consciously realise it existed. The exercise we did together was very emotional for her because on the one hand she was very pleased she had a small mortgage and was aware that she was in a much better position than most and if anything ever did happen well she would always be able to earn enough to repay her mortgage so she was never going to be homeless and rather than taking that for granted, she became more grateful and was proud of herself for that. When she spoke about her wedding and honeymoon and the amount they spent on it, she thought it shouldn’t be in The Bad section but more like The MAD section but then there is no movie I think called The Good, The Mad and The Ugly. Anyway, what was done was done, it couldn’t be taken back and no point beating, yourself, up about and when I asked her if she had her time all over again would she have done the same thing, she answered without hesitation – YES. They had incredible memories of it with friends and family and life can be short and often cruel so they will always remember that experience. Talking about their wedding made her think of her husband and she joked that they got married for better and for worse and you know he had been trying incredibly hard to get a job, she realised that and if she was feeling under pressure god only knows how he must be feeling, so she resolved to move resentment off her ugly list simply by talking to him about how she is feeling. And of course, doing this exercise wasn’t and isn’t all about the emotional aspects of her finances, they are absolutely important because they give her the why to make those changes so the ugly becomes the bad that eventually becomes the good. And she is going to have to do the things she doesn’t like doing like budgeting, planning her shopping trips, not going on holidays this year etc. And I would encourage you to think about what’s good, bad and ugly about your finances (I think I sound like Father Trendy here) because only when you do, can you begin to see what’s really important and then resolve to do something positive about them.

He is not altogether wrong but at its core planning for your future income is based on some guesswork and assumptions. You have to make a guess as to what your expenses will be in 25 or 30 years’ time you have to assume how much your pension fund will grow by, what age you want to retire at and so on and some of these things are hard to predict and have control over.

There is a rule of thumb in the pension industry that says you need to save enough money to be able to live off about 67% of your pre-retirement income. If you earn €80,000 for example you should plan to have c. €53,600 per year when you retire. I completely disagree with this method and it amazes me how stupid this idea, something most banks and financial advisors peddle. When planning for retirement income you should plan and be guided by what your current expenses are. And you should benchmark this amount from what your current outgoings are by the way. A client of mine (age 37) earns €65,000 per year and if he was to plan for an income to replace 67% of that i.e. €43,500 as was suggested by his bank, he would need to have saved c. €1,309,058 in his pension fund and in order to do this he would need to put away about €33,000 each year for the next 28 years which of course would not be possible. And when you hear things like this, what do you do, you do nothing, you give up because why bother when you have no chance of succeeding – when we carried out the exercise I am just about to tell you about we identified that he needed c. €2,200 per month which meant he needed a fund in his pension at 65 of €360,900 and not €1,309,058. So rather than just pick an arbitrary number based on your salary, a figure that you will find next to impossible to replace, look at what your current monthly outgoings are and do the following: Step 1 Complete an income and outgoings budget showing what you typically spend your money on each week, month and year. You don’t have to be terribly accurate to begin with, guesstimates are fine. Step 2 Now deduct from this budget your current expenses that you will no longer be required in retirement i.e. mortgage repayments, life assurance premiums, car repayments, savings plans, costs associated with children etc. Now don’t forget to add expenses that currently come out of your salary that you will have to pay out of pocket once you are retired. And what extra expenses do you want to budget for during retirement - these would include things like travel, or extra money for medical expenses. Step 3 Subtract other sources of income you may be in receipt of such as rental or investment income or the state contributory pension or any other pension income you may have from what you estimate your annual expenses will be. The amount left over is the amount you will need to withdraw from your pension fund so whatever this figure you are left with is, is the amount you will need to spend in a given year, and you now need to multiply it by 25. Here is an example: Expected Retirement Expenses €40,000 per annum Other pension including state contributory pension €15,000 per annum Rental and investment income €7,500 per annum Sub Total €22,500 per annum Shortfall €17,500 per annum Pension fund requirement is €437,500 (€17,500 x 25) The reason for multiplying by 25 is based on the amount you can withdraw from your pension fund but it doesn’t factor other things in like rental or investment income, the state contributory pension etc. and this rule of thumb assumes you will be able to generate an annual return of 4% on your pension fund. It assumes that over a 15 to 20 year term your pension fund will produce returns of 6% (Warren Buffett predicts this is what stock market indices will return over the next few decades) Inflation will erode the value of your Euro at an average long term rate of 2% meaning your real return after it is taken into account is about 4%. Another pension rule of thumb is called the 4% rule and it is linked to the Rule of 25 but the 4% rule is based on the amount you can withdraw without depleting your fund each year. For example you retire with €300,000 in your portfolio, you should withdraw 4% of it i.e. €12,000 per year. Of course you can withdraw a lot more but eventually and depending on how much you need, the fund could run out. If for example you were withdrawing €30,000 per year, then in 10 years your fund would eventually run out. So, the Rule of 25 estimates how much you will need in your retirement fund and the 4% rule estimates how much you should withdraw from your fund each year after you have retired. Do you need to adjust for inflation? And the answer is yes of course you do. If for example you want to withdraw €30,000 from your pension fund each year and you are 25 years away from retirement then you your inflation adjusted target is €80,100. Here is a quick summary of how you can factor in inflation: If you are 10 years away from retirement multiply your target income by 1.48 If you are 15 years away from retirement multiply your target income by 1.80 If you are 20 years away from retirement multiply your target income by 2.19 If you are 25 years away from retirement multiply your target income by 2.67 The Rule of 25 and 4% rule are not without their draw backs and should be used as a guide only. It is hard to predict with any certainty what tax rates will be in the future, what the state contributory pension will be, what utility costs will become decades from now so the bottom line here is to at least start and aim for something and yes there are what I refer to as what we know and what we don’t i.e. the unknowns and these are things that yes you need to be aware of and be able to react to which is why it is important to build in flexibility into your plan so that you have the safety net to fall back upon i.e. don’t rely too much on the state pension, try and plan for without it or it you are planning to include it maybe take 50% from what the current rates are – this is one of the reasons I encourage people to slightly over estimate how much they will need in retirement. |

Archives

September 2015

Liam CrokeManaging Director of Harmonics Financial Categories |

Harmonics Financial Ltd., Registered Office Mary Rosse Centre, Holland Road, National Technology Park, Limerick. Directors: Liam Croke QFA BBA LIAM, John Fitzgerald

Incorporated in the Republic of Ireland, Central Bank of Ireland No: C86227. CRO No: 481477

Harmonics Financial Ltd. is regulated by the Central Bank of Ireland.

Incorporated in the Republic of Ireland, Central Bank of Ireland No: C86227. CRO No: 481477

Harmonics Financial Ltd. is regulated by the Central Bank of Ireland.