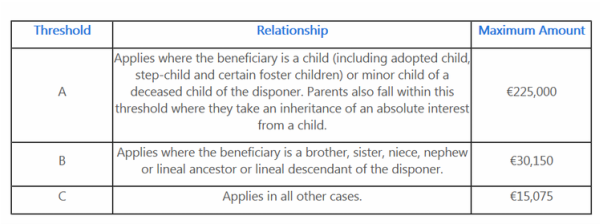

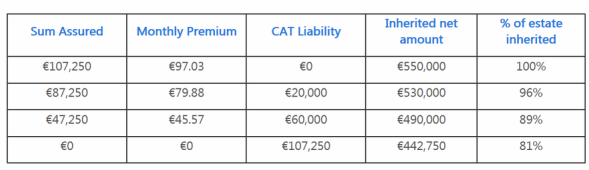

The amount you can gift or inherit from someone depends on your relationship with them. There are currently three bands that have different thresholds at which they can receive a lump sum without incurring any liability and they are: Anything above each threshold is taxed at 33% - so the value of what a child would inherit would have to be not greater than €225,000 before capital acquisition tax (CAT) kicks in. If someone for example was to inherit a property worth €450,000 and cash worth €100,000 then the amount that would be payable to Revenue would be €107,250 i.e. €550,000 - €225,000 x 33%. The threshold amounts have gradually come down each year whilst the tax rate has increased. For example back in 2009, a child could inherit €542,544 from a parent, and the balance was taxed at 22%. Anyway, is there anything that can be done to prevent this from happening? And the answer is YES. There is a life assurance policy often referred to as a Section 235a policy which is arranged for the specific purpose of providing funds on death to pay inheritance tax likely to arise from the death of the policy holder. The term Section 235a refers to the section of the Capital Acquisitions Tax Consolidation Act 2004 which provides a relief for inheritance tax for the proceeds of policies arranged for this purpose. The proceeds of a Section 235a policy are also exempt up to the amount of any approved retirement fund (ARF) tax arising from the death of the deceased policyholder. If we look at the figures I have just used, the cost of putting a policy in place to eliminate an inheritance liability of €107,250 for a 45 year old male would be €97.03 per month (this monthly premium is the best in the market and is with Irish Life) Let me give you an example of what this would look like and what other amounts would cost as well: I think it is worth looking at this further based on the value of your own estate and what your children will be faced with now when you are young enough to do so because as you get older and your estate becomes more valuable, the cost of taking out such a policy would be so large it would really become prohibitively expensive.

I have come across many people who are inheriting money from their parent’s estate and the amount they have to give away in inheritance tax is enormous and they only wish their parents knew of or took out such a policy when they were young enough to do it. It would have saved them hundreds of thousands of Euros, and of course some parents take the view that the amount their children inherit is going to be large anyway even after paying Revenue so it depends on your outlook. There is a second way of avoiding incurring this liability particularly if the property you inherit is your principal place of residence along with other conditions that are

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2015

Liam CrokeManaging Director of Harmonics Financial Categories |

Harmonics Financial Ltd., Registered Office Mary Rosse Centre, Holland Road, National Technology Park, Limerick. Directors: Liam Croke QFA BBA LIAM, John Fitzgerald

Incorporated in the Republic of Ireland, Central Bank of Ireland No: C86227. CRO No: 481477

Harmonics Financial Ltd. is regulated by the Central Bank of Ireland.

Incorporated in the Republic of Ireland, Central Bank of Ireland No: C86227. CRO No: 481477

Harmonics Financial Ltd. is regulated by the Central Bank of Ireland.